PROGRAMA ALTO RENDIMIENTO

CON MENTORIZACIÓN IN-STREAMING X METAS

- Incubadora de Traders

- MPP Trading con IA

- Con gestión de riesgo automatizado

- Con análisis y filtros de fiabilidad basados en IA

- Sin cuentas de fondeo ni soluciones milagro

- Sistematizando la ejecución con pautas claras, donde no influyen las emociones

TRADERS DE ALTO RENDIMIENTO

Mentorización In-Streaming x Metas

Una nueva generación de Traders independientes capaces de usar la tecnología de forma intuitiva operando in-streaming todas las semanas. El mentoring de alto rendimiento es un programa pionero estructurado en habilidades prácticas orientadas a resultados que se realizan en etapas y fases de dificultad gradual con tutores que te guían y mentorizan en el proceso, miles de personas se han formado con nuestro método. Puedes ver sus resultados en vivo en la sesión informativa.

1

Incubadora de Traders

En este nivel, empezaremos desde cero, aprenderás a gestionar tu cuenta de trading de manera independiente. Se revisarán las bases de tu operativa, asegurándonos de que comprendas el análisis de valores, la ejecución de sistemas de inversión, los tipos de sistemas de trading, y que cumplas con los ratios necesarios.

2

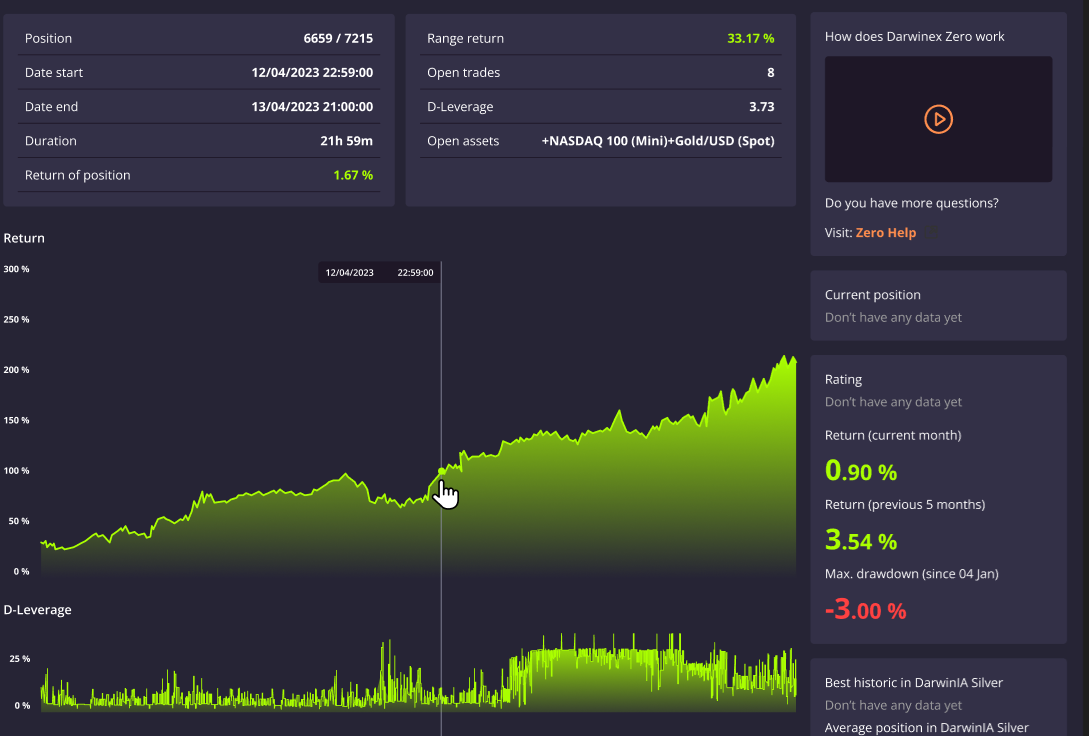

Herramientas avanzadas MPP

Tutorizaremos la implementación de tu operativa paso a paso ayudándote a analizar tus ratios y mejorarlos. Te enseñaremos a profesionalizar la ejecución de tu operativa mediante plataformas como Darwinex Zero o Myfxbook, que auditan y analizan tus resultados en vivo.

3

Mentorización y práctica x metas

En este nivel, te mentorizamos la ejecución operativa y te ofrecemos 10 nuevos sistemas avanzados basados en herramientas que utilizan IA, entre otras, para mejorar la gestión de riesgos y la calidad de las entradas, reduciendo las pérdidas de capital.

El PROGRAMA DE ALTO RENDIMIENTO se estructura en tres fases: INCUBADORA, MPP y MENTORIZACION

LAS BASES

Incubadora de Traders

Esta formación está enfocada a primero que asientes las bases que se deben cumplir en todos los sistemas de trading y segundo mentorizarte en la aplicación de los sistemas de trading para que lleves a cabo una operativa con buenos resultados a largo plazo.

Los Sistemas de Inversión

Un programa pionero e innovador dividido en temarios teórico-prácticos que te permitirán empezar desde cero hasta llegar a ser un trader profesional. El objetivo de la INCUBADORA DE TRADERS es que el alumno aprenda a invertir en el mercado de valores de forma eficaz, aplicando los métodos y estrategias adecuados a los cambios de mercado según el estilo de operativa propio de Instituto IBT.

- Introducción

- Sistemas de Trading

- Fiabilidad

- Profit factor

- Gestión monetaria

- Validación

- Trading cuantitativo

- Equipo de gestión profesional

HERRAMIENTAS AVANZADAS

MPP Trading Tools con IA

Disfruta de la gran palanca que supone el uso de herramientas cuantitativas a la hora de acelerar resultados, compatibles con el bróker de tu elección y parametrizables según tus criterios de inversión.

Te enseñaremos cómo comercializar tu estrategia de trading, realizar la función de money manager en una mesa de negociación o convertirte en trader mentor bajo el patrocinio de IBT.

MPP: Herramientas cuantitativas IA

- Trading Management y el proceso de Trading

- Gestión de la operativa I. Gestión del Trading

- Asesores expertos de Trading avanzados: Trading Tools

- Gestión de Riesgo. Caracterización de la operativa I

- Gestión de Riesgo. Caracterización de la operativa II

- Hedge Funds & Private Equity

- Análisis Predictivo y filtrado colaborativo: Algoritmos de recomendación basados en IA para sugerir activos financieros o estrategias de trading personalizadas.

- Herramientas de Gestión de Riesgo: Estas herramientas basadas en IA se centran en la gestión de riesgos, evaluando y controlando los posibles riesgos asociados con las decisiones de trading. Utilizan algoritmos avanzados para analizar la volatilidad del mercado y el historial de operaciones.

- Sentimiento del Mercado: Herramientas que emplean modelos de aprendizaje automático para analizar patrones de mercado, tendencias y sentimiento del mercado basado en noticias y correlaciones.

VALIDAZACIÓN TRACKRECORD

Mentorización In-Streaming

Comunidad IBT - Darwinex

- Metas prácticas mentorizadas para llevar tu operativa al siguiente nivel.

- Al inicio de la fase de Mentoring: Sesion personalizada de análisi de tu operativa en una sesión directa con Ana Lara y un plan de acción detallado de los pasos a seguir.

- Todas las semanas conexión en vivo con 3 expertos en cada una de las áreas principales dela operativa para ayudarte meta x meta a optimizar tus resultados

Experto en la operativa de scalping

Profesor de Instituto IBT Sevilla.

Graduada en Física

Programadora de estrategias de trading en Sevilla.

Graduado en Economía. Máster en Bancas y Asesoramiento Financiero.

Director de Instituto IBT Madrid.

Durante las etapas del mentoring cuentas con el seguimiento de tres tutores especialistas cada uno en un área: operativa, sistemas y herramientas; y un mentor dedicado a la optimización y personalización de tus resultados. Este programa está dirigido por Ana María Lara, experta en trading de arbitraje y trading algorítmico desde 2005 que ha liderado diversos proyectos en el sector y que se dedica a la creación y desarrollo de estrategias de algoritmos de inversión a nivel institucional. Junto a su equipo dirige el programa, al inicio, analizará tu sistema de trading y realizará un plan de acción personalizado con todos los puntos de mejora y pasos a seguir durante la formación. Contarás con el apoyo de sus propio equipo durante todas las fases del programa.

Accederás a la comunidad de Traders

In-Streaming con la colaboración de

Instituto IBT ha realizado una colaboración educativa con Darwinex-Zero para ayudar a los alumnos en la optimización de resultados

Sesiones de Mercado y Clases en directo

con resolución de dudas en vivo

Comparte tu progreso, resuelve dudas en directo y rodéate de gente como tú, con muchas ganas de aprender

¿A qué esperas para unirte a nuestra comunidad presencial virtual en Discord?

ACCESO A LA COMUNIDAD DARWINEX-IBT

RANKING DE TRACKRECORDS

Ranking de TrackRecords en vivo de alumnos y profesores

WEBINARS EXCLUSIVOS POR EXPERTOS DE DARWINEX-ZERO

Mentores de apoyo en la optimización de resultados y de la operativa pasos a paso

GRUPO EN DISCORD DONDE COMPARTIR DUDAS EN VIVO CON EXPERTOS

Apoyo de 3 expertos en las áreas más importantes del trading

Darwinex Zero es un entorno seguro donde los clientes adquieren hábitos de trading saludables, construyen su historial y se preparan para atraer capital de inversores de forma escalable

A través de Darwinex-Zero y de nuestros tutores podrás

Análisis de errores

- Análisis algorítmico basado en inteligencia artificial para identificar comportamientos, errores y habilidades a mejorar en tu operativa. Se analiza el drawdown y el score de tu operativa

- Analice los datos para identificar fortalezas y debilidades (comportamiento, histórico, riesgo, habilidades necesarias)

- Minimice errores y maximice rentabilidad

- Realice potentes análisis de rendimiento

- Controle su progreso a través de su puntuación personal PQ Score

Optimización de resultados

- Sistemas automáticos de identificación de entradas para incrementar la frecuencia operativa

- Optimización de la gestión de posiciones mediante análisis de valores con market profile

- Podrás comparar tu operativa con traders y gestor de fondos en activo

- Plantillas y herramientas de análisis de valores

- Compare su puntuación con la de los mejores traders

Clases In-Streaming y

seguimiento premium

Clases en Directo y seguimiento premium

Una vez que inician las clases, se comparten estas grabadas en vídeo junto a otro apoyo en PFD y un simulador de bróker, facilitando así la flexibilidad y el estudio del alumno. Además cuestas con un profesor para cualquier duda.

Start Sesion estratégica

Toma de contacto con el tutor, con el objetivo de estructurar y orientar el proceso formativo en base al perfil del alumno, conocer sus objetivos personales para orientar la formación en base a ellos

Profesor para resolver dudas In-Streaming

La formación se estructura en fases con objetivos a alcanzar, en las que los profesores imparten las clases in-streaming y resuelves las dudas en vivo en distintos horarios y mercados.

Sesiones de mercado en vivo en distintos mercados

Las explicaciones prácticas y las sesiones de mercado se realizan en emisiones en vivo, pudiendo preguntar dudas en directo. En el caso de no poder atender, quedarán grabadas y podrás verlas más tarde, así como resolver posibles dudas si lo necesitas

Sesión one to one para la optimización de resultados

A través del análisis de las métricas conseguidas en los ejercicios prácticos, tu mentor asociado te ayudará en una sesión one to one adicional a detectar los puntos fuertes de la operativa y potenciarlo.

Soporte a las herramientas Trading con IA

Al superar la fase de validación en demo realizaremos una tutoría One to One para ayudarte a instalar las herramientas Trading con IA y orientarte en las siguientes metas a alcanzar.

Titulación

* Enseñanzas que no conducen a la obtención de un titulo con valor oficial.

Titulación Acreditativa emitida por Instituto IBT

Programa de Alto Rendimiento Trader con IA

MBA en Bolsa y Trading

Emitida por la Universidad Americana de Europa (UNADE).

Máster en Formación Permanente

Emitida por la Universidad Católica San Antonio de Murcia (UCAM).

Únete a la nueva comunidad de Traders in-Streaming

¿Quieres unirte a la nueva generación de Traders independientes capaces de usar la tecnología operando in-streaming todas las semanas?